What We’ll Unpack in This Article (TL;DR)

CFOs need to focus on inventory metrics that directly impact financial performance, not just operational data.

- Track on-hand inventory value to see how much cash is tied up.

- Monitor inventory turns to balance supply and demand.

- Keep an eye on COGS to protect margins from supply chain volatility.

- Reduce carrying costs by pruning slow-moving or excess stock.

- Recalculate EOQ regularly to optimize order sizes and cash flow.

By aligning inventory insights with financial decision-making, CFOs can free up capital, safeguard margins, and drive growth.

For Chief Financial Officers (CFOs), inventory is both a lifeline and a liability. On one hand, it represents the products that keep customers happy and revenue flow. But it can be tricky to balance, and can quickly tie up massive amounts of capital, eat into margins, and add significant carrying costs that erode profitability. That’s why finance leaders can’t afford to leave inventory performance up to chance. Instead, they need to leverage the right set of inventory performance metrics, which provide visibility into how inventory decisions influence cash flow, gross margins, and customer service levels.

How can CFOs know which metrics to track? When you’re a financial executive, not every metric matters. Pick accuracy and forklift utilization are useful for operations managers, but less helpful for CFOs – they should be focused on higher-level indicators that are connected directly to financial outcomes, and which point to the root cause of issues.

Here are the inventory performance metrics CFOs should be tracking – and what to do about them.

How Can CFOs Turn Inventory Insights into Measurable Financial Wins?

CFOs make mission-critical decisions that dictate how a business performs. When it comes to inventory, it’s not enough for these financial executives to just glance at surface-level data snapshots. They need deep insights into inventory performance metrics that reveal things like how much capital is locked in excess stock, whether forecast accuracy is freeing (or draining) cash, and what’s causing inventory issues.

These KPIs aren’t just operational scorecards – they’re levers CFOs can pull to unlock capital, protect margins, and fund growth. The challenge is moving from raw data to clear financial impact. Here’s how finance leaders can bridge that gap:

1. Monitor inventory value and movements

Inventory is often one of a business’ largest expenses, with data from the U.S. Department of Commerce showing that for every dollar retailers make, they have $1.40 of inventory in stock. By tracking inventory metrics, CFOs can understand the true value of their inventory, and make better informed ordering decisions (like which SKUs to order, in what quantities, and when).

2. Reduce inventory distortion

Research from IHL Group shows that inventory distortion (including overstocking and understocking) costs businesses $1.77 trillion globally. Monitoring key metrics help CFOs balance their inventory – avoiding both costly overstocking and the missed revenue opportunities that come with stockouts.

3. Track (and act on) supplier performance

Suppliers can be a hidden source of financial and organizational stress. By using vendor insights (like on-time delivery, lead time trends, and completeness), CFOs can choose vendors that meet their needs – whether that’s speedier delivery or cheaper costs

Ultimately, CFOs who align inventory insights with financial decision-making can improve supply chain efficiency, and execute measurable wins in areas like cash flow, margins, and growth.

Top 6 Metrics That Matter to CFOs (and What to Do)

With that in mind, here are the top 6 inventory performance metrics that matter to Chief Financial Officers – and how they can best act on these insights.

1. On-hand inventory value

Why CFOs care: The value of all of the inventory your company has. This is one of the clearest indicators of how much cash is tied up in individual items, and shows the value of each SKU.

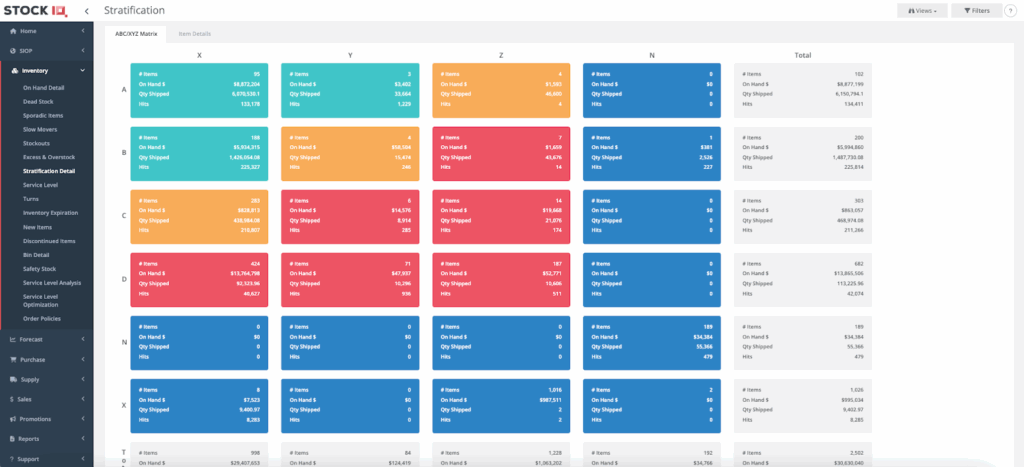

What to do about it: This number can be interesting on its own, but when combined with other data (such as Cost of Goods Sold), it’s extremely revealing. For example, by applying ABC stratification, you can see which items are driving revenue and margin, versus those that tie up capital with little return. Also, when cross-referenced with demand forecasts, you can align ordering decisions with the reality of your needs.

2. Inventory turns

Why CFOs care: Inventory turns measure how many times stock is sold and replaced in a given period of time. Low turns typically signal capital is stuck in slow-moving products, which comes with higher carrying costs and risk of obsolescence. High turns generally indicate efficient use of working capital and better alignment between supply and demand (although it can also signal insufficient stock levels).

What to do about it: Depending on the state of your inventory turns, you can consider a few actions. By calculating your average turns and target turns, you can understand your current status and take corrective action. For example, if your turns are too low, you might seek to improve forecast accuracy (which reduces the need for excess stock) or recalculate your safety stock levels. If turns are too high, it can signal understocking and lost sales. The key is balance.

3. Cost of goods sold

Why CFOs care: Cost of Goods Sold (COGS) is a critical metric which is heavily influenced by inventory and supply chain decisions. Shifts in supplier pricing, supply chain tariffs, freight costs, or even poor ordering practices can erode gross margins before sales teams ever get involved. If cost issues aren’t identified and addressed quickly, companies may find themselves selling products at little-to-no margin.

What to do about it: To connect COGs insights to margin protection, CFOs should:

- Monitor landed costs in real time, factoring in supplier costs, tariffs, and freight to see the true COGS picture (beyond purchase price).

- Leverage warnings in your WMS or inventory management system. Alerts can flag you when costs push an SKU into unprofitable territory.

- Diversify materials sourcing strategies. Explore domestic or alternative suppliers who may offer more predictable costs and shorter lead times.

4. Carrying costs

Why CFOs care: Carrying costs are the “hidden tax” of holding inventory. They include storage, insurance, depreciation, shrinkage, and obsolescence. Unlike purchase price, these costs don’t show up clearly on a supplier invoice: they quietly accumulate, making them especially important for CFOs who are laser-focused on profitability and cash flow.

What to do about it: CFOs can identify excess and slow-moving SKUs to highlight stock that ties up capital but isn’t moving. You can also rationalize SKUs, pruning low-margin or low-demand products to avoid holding costs that don’t contribute to profit.

5. Economic Order Quantity

Why CFOs care: Economic Order Quantity (EOQ) is a classic inventory calculation for determining the optimal order size based on cost. Ordering small quantities too frequently drives up administrative and transportation costs, while ordering too much can inflate inventory value and holding costs. In long-lead-time industries – where supplier commitments can run 90-150 days – getting EOQ wrong can tie up large quantities of cash very quickly.

What to do about it: Regularly recalculate your EOQ assumptions as supplier lead times, transportation rates, and carrying costs change (especially in volatile markets). Also, use differentiated policies (ABX/XYZ stratification) to apply distinct order rules for high-value, predictable SKUs versus low-volume or volatile ones.

6. Excess/slow-moving stock

Why CFOs care: Excess and slow-moving items consume capital, rack up carrying costs, and often end up as dead stock, sold for deep discount sales. Unlike safety stock, which serves a purpose, excess stock adds little-to-no value while lampooning profitability.

What to do about it: CFOs can avoid and correct excess and slow movers by:

- Tracking burn-down timelines, or how long current inventory would last if nothing new was purchased, to help determine when they should replenish SKUs.

- Deploying zero-demand analysis, to identify SKUs with no forecasted demand to stop the cycle of reordering obsolete items.

- Rebalancing surplus stock to markets or warehouses with stronger demand.

For CFOs, inventory performance metrics are more than just numbers on a spreadsheet – they’re critical insights that play a central role in strong financial strategy. By pairing financial oversight with supply chain intelligence, CFOs can tap into metrics that free up capital, protect their margins from volatility, and transform inventory from a source of risk into a competitive advantage.

Find Out Why CFOs Choose StockIQ for Tracking Top Metrics

CFO’s don’t just need visibility into raw numbers – they need inventory performance metrics that connect operations to dollars and cents. That’s where StockIQ comes into play. Unlike ERP systems that just skim the surface, StockIQ digs deep into pre-warehouse supply and demand planning, giving CFOs real-time dashboards that tie inventory performance directly to financial outcomes. With tools like AI-powered demand forecasts, advanced inventory analysis, supplier performance monitoring, and inventory replenishment planning, CFOs can see what’s happening – and make informed decisions.

Are you interested in learning how StockIQs supply chain planning suite can support your executive-level financial work? Contact us today or request a StockIQ demo.