What We’ll Unpack in This Article (TL;DR)

As supply chains become more complicated and risk grows, financial executives are becoming increasingly involved in global supply chain management. With the distance between financial performance and supply chain decisions collapsing, CFOs need to align with the global supply chain.

This can be done by:

- Rooting supply chain decisions in a shared set of numbers (such as accurate demand forecasts).

- Treating inventory as a strategic investment.

- Integrating forecasting, supply planning, and supply planning processes.

- Using sophisticated supply chain technology as the connective tissue.

This guide is designed to help CFOs understand what meaningful alignment looks like and how to execute it.

Chief financial officers (CFOs) have long played a role in supply chain decisions, weighing in on cash flow, margins, and capital allocation. But recently, as supply chains become more complicated and risk grows, CFOs are becoming even more involved in global supply chain management. Now, modern CFOs are increasingly expected to weigh in on questions that used to sit squarely with operations: How much inventory is too much? Where should we hold risk? When does protecting service undermine margins?

Today’s operating environment has collapsed the distance between financial performance and supply chain decisions. This guide is designed to help CFOs navigate that shift. We’ll explore what meaningful alignment looks like, why it matters more than ever, and how finance leaders can use data, planning discipline, and shared metrics to their advantage.

CFOs and Global Supply Chain Outcomes: A Symbiotic Relationship

CFOs may not manage suppliers, place purchase orders, or set reorder points, but their decisions increasingly determine how the global supply chain performs. Similarly, supply chain performance greatly impacts things a CFOs cares deeply about, such as cash flows and margins.

At a fundamental level, every global supply chain decision is a financial one. Inventory represents committed cash. Lead times dictate how long capital is tied up before revenue is realized. Service-level targets determine how much buffer stock is required. When these decisions are made without proper financial context, organizations often experience the same symptoms: excess inventory, margin erosion, and reactive cost-cutting that undermines service.

This interdependence is why CFOs are now deeply embedded in global supply chain outcomes. And it shows in CFO priorities: research from Taulia shows that 30% of CFOs say supply chain disruptions are their greatest concern.

High-performing organizations realize the symbiosis between CFOs and global supply chain outcomes, and embrace it. Instead of finance reacting to inventory outcomes after the fact, CFOs and supply chain leaders align upfront on assumptions, trade-offs, and priorities.

What Does Alignment Between Finance and Global Supply Chain Management Look Like?

True alignment between finance and global supply chain management extends beyond who owns what: it’s reflected in how decisions are made, measured, and reinforced across an organization. In aligned organizations, supply chain decisions are rooted in financial realities.

Here’s what that alignment looks like:

- A shared set of numbers: Supply chain decisions are made based on universal truths – accurate demand forecasts, inventory outlook, and planning assumptions. Teams focus on what inventory decisions imply for cash flow, service, and risk.

- Inventory treated as a strategic investment: Inventory is not simply minimized to improve working capital, nor is it inflated to protect service at all costs. Instead, it is managed as a deliberate investment. Finance helps quantify the cost of higher service levels, longer lead times, and forecast error, while demand planners translate those financial guardrails into practical stocking and replenishment strategies.

- Integrated planning, not parallel planning: Forecasting, supply planning, and financial planning are connected through common processes (often through S&OP). This allows revenue plans, inventory investments, and margin expectations to remain synchronized as conditions change. For example, one McKinsey study of 100 companies found that 82% of supply chains are affected by new trade tariffs. An aligned organization will turn to their CFO to understand how tariffs will impact key metrics (like COGS) and supplier performance.

- Metrics that universally matter: CFOs and supply chain leaders track not only historical performance, but forward-looking indicators such as projected inventory, service-level investment, forecast accuracy, and excess exposure. These metrics enable proactive conversations about trade-offs, allowing leadership teams to make informed decisions that protect margins and customer service simultaneously.

- Tech as the connective tissue: The right supply chain technology is the glue that makes true alignment possible at scale. Spreadsheets and static reports only surface problems only after financial impact has already occurred. But modern demand planning tools connect forecasts, inventory positions, lead times, and service levels directly to financial outcomes. They also go deeper than other solutions (such as an ERP or POS) – quantifying forecast accuracy, modeling safety stock requirements, and simulating trade-offs between service levels and cost.

When alignment is in place, finance isn’t just responding to supply chain outcomes – it’s helping design them.

How Can CFOs Use Inventory Strategy to Improve Resilience and Cash Flow?

For modern CFOs, inventory strategy is one of the most powerful (and often underutilized) levers for improving both resilience and cash flow.

Here’s how finance leaders can use inventory strategy to strengthen the business:

- Treat inventory as a planned financial investment: Shift your mindset from “inventory reduction” to “inventory optimization,” and align levels with service priorities, margin contribution, and risk tolerance. Make deliberate choices about where you want excess, instead of ordering “just in case.” This prevents overstocking, and locking up capital in unnecessary stock.

- Reduce safety stock through better forecasting: Forecast error is a primary driver of excess inventory, and can lead to higher safety stock levels. By improving forecast accuracy, you can lower your required safety stock – without increasing risk.

- Segment inventory to protect cash where it matters most: Not all SKUs deserve the same service levels or investment. High-margin, high-velocity items may justify higher buffers, while slow-moving or low-margin items should carry tighter policies. Use a system such as ABC analysis to easily segment inventory and inform buying decisions.

When inventory strategy is aligned with financial objectives, CFOs can use inventory as a controlled, forward-looking lever – protecting service, stabilizing cash, and preserving margins, even in uncertain global supply chain conditions.

StockIQ: A CFO’s Secret Weapon for Global Supply Chain Management

As global supply chains grow more complex and risky, CFOs can no longer afford to sit downstream of inventory planning decisions. The organizations that win are the ones where finance helps architect supply chain outcomes.

That’s where StockIQ becomes a strategic advantage for competitive CFOs.

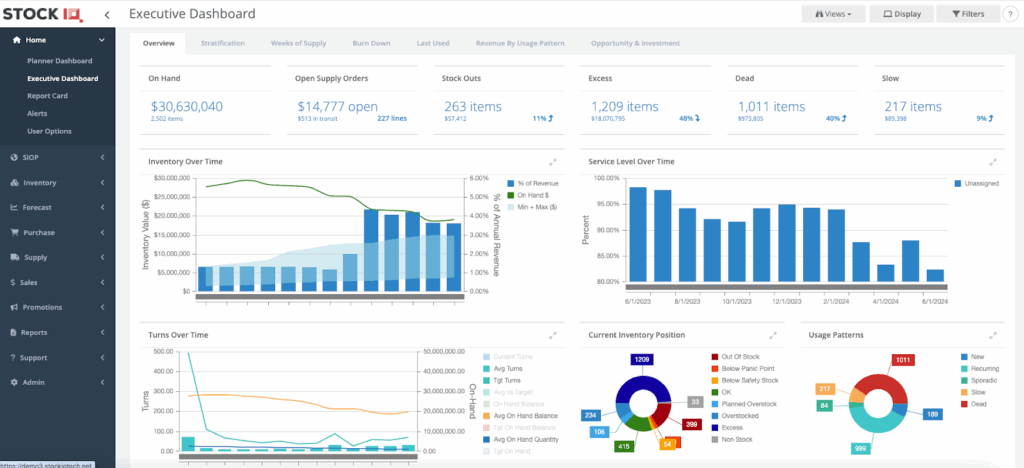

StockIQ is inventory management software designed to address the root causes of inventory and cash flow challenges. By focusing on forecasting accuracy, service-level optimization, lead-time management, and inventory investment before orders are placed, StockIQ gives finance leaders the visibility and control they need to excel.

Find out how StockIQ can help align finance and global supply chain management by contacting us today or requesting a StockIQ demo.

Frequently Asked Questions About Global Supply Chain Management

1. Why should CFOs be involved in global supply chain management?

Because supply chain decisions directly shape financial outcomes. Inventory levels determine how much cash is tied up, service levels influence margin and revenue risk, and lead times affect working capital velocity. When CFOs are involved upstream, they can help ensure supply chain decisions align with cash flow, margin, and risk objectives.

2. What does alignment between finance and global supply chain management look like?

When finance is aligned with a global supply chain, you see it in:

- Shared source-of-truth numbers, such as demand forecasts and inventory outlook.

- Inventory treated as a strategic investment.

- Integrated planning through common processes.

- Universally valued metrics.

- Supportive technology, which allows true alignment at scale.

3. How can CFOs use inventory strategy to their advantage?

CFOs can use inventory strategy to improve resilience and cash flow. First, treat inventory as a planned financial investment – align levels with service priorities, margin contribution, and risk tolerance. Next, reduce safety stock through better forecasting. Lastly, segment inventory to determine your ordering policies. High-margin, high-velocity items may justify higher buffers than slow-moving or low-margin items.